Medicare Supplements

While Medicare provides great coverage for seniors and others that are eligible, it doesn’t cover everything. Fortunately, Medicare Supplement (Medigap) plans are available to help cover these out-of-pocket costs.

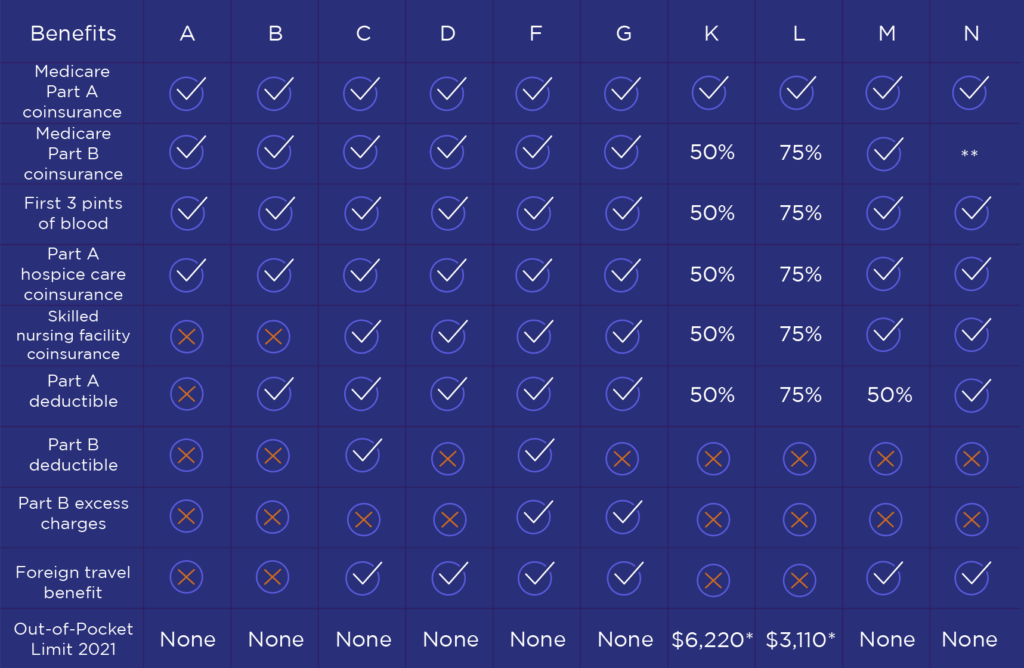

There are 10 Medigap plans available in 47 states. At American Family Solutions, we can help you determine which plan is right for you.

10 Medigap Plans:

What is Medigap?

Medigap plans are designed to supplement your Original Medicare (Part A and B) coverage. The out-of-pocket costs that can be covered by a Medigap plan include:

- Part A Coinsurance & Hospital Costs

- Part B Coinsurance/Copayment

- First 3 Pints of Blood for Transfusions

- Part A Hospice Care Coinsurance/Copayment

- Skilled Nursing Care Facility Coinsurance

- Part A Deductible

- Part B Deductible

- Part B excess Charges

- 80% of Foreign Travel Emergency Care

The coverage you receive will ultimately depend on the Medigap plan you choose to enroll in.

When Can I Enroll in Medigap?

The best time to enroll in Medigap is during the Medigap Open Enrollment Period. This period begins as soon as you are 65 and enrolled in Original Medicare. It lasts for a total of six months, giving you this amount of time to buy a Medigap plan without being turned down for coverage.

If you miss this period, you can still enroll in Medigap, but it will be much harder to find a plan. Medigap insurance companies can choose to deny you coverage or make you go through a medical underwriting process to determine your eligibility.

WE’RE BUILT ON RELATIONSHIPS

Want to Know More About Medigap? Give Us a Call Now

We offer free claim support for life!

At American Family Solutions, we will find you the Medigap plan that works best for you. Reach out to us today to go over your Medigap options! Call for a FREE quote comparison!