Medicare Part D

Having a Medicare Part D prescription drug plan makes affording your prescriptions much easier. This part of Medicare can be purchased as a standalone plan while enrolled in Original Medicare (Part A and B) or it can be included as an additional benefit in a Medicare Advantage (Part C) plan.

What Does Part D Cover?

Part D covers at least two prescription drugs from each class/category and includes coverage for all drugs listed in these categories:

- Immunosuppressants

- HIV/AIDS drugs

- Antipsychotics

- Antidepressants

- Anticancer

- Anticonvulsants

The specific list of drugs that a Part D plan covers is known as a formulary. To know if your prescriptions are covered, you will need to look at the plan’s formulary and see if it’s the right choice for you.

What Does Part D Cost?

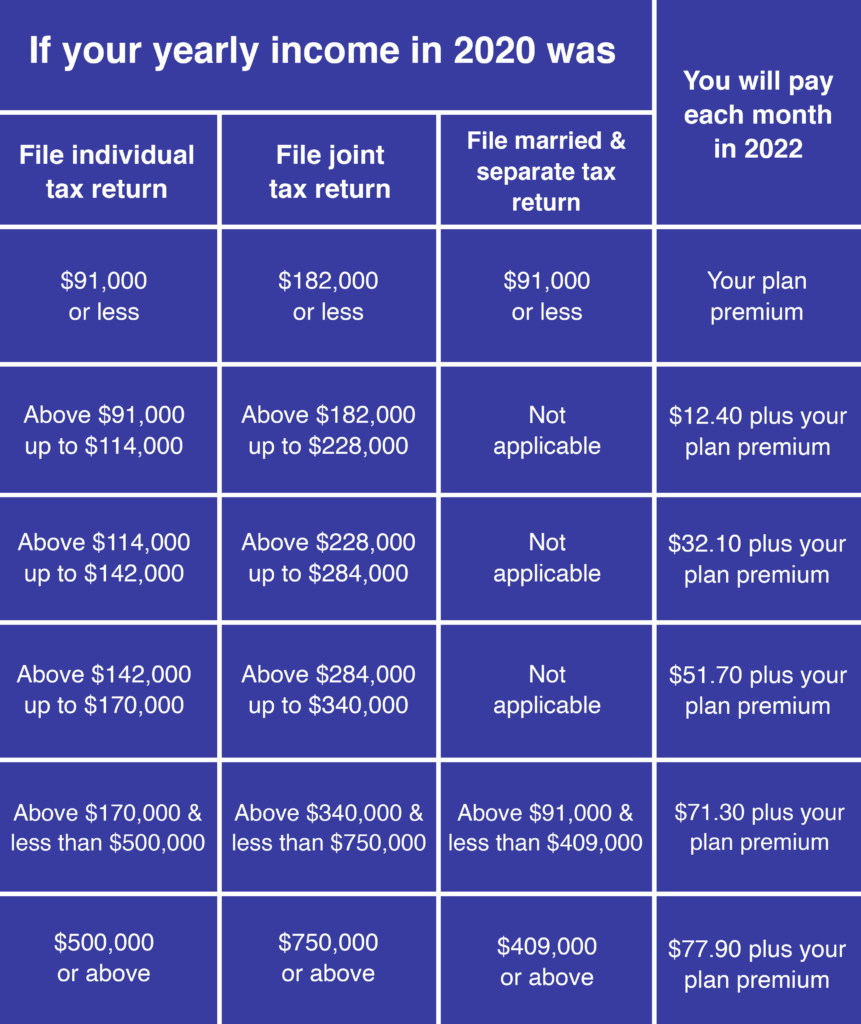

The costs for Part D will vary by plan. Your premium costs will also be determined by your income. The average monthly premium is $33 in 2022, but this can be higher if your income is above a certain amount. This higher amount is known as the Income-Related Monthly Adjustment Amount (IRMAA).

The amount you pay extra will be determined on what you filed on your taxes from two years ago. Here are the costs you can expect to see in 2022 for Part D:

Some Part D plans also have a yearly deductible. If a Part D plan has a yearly deductible, it cannot exceed $480.

WE’RE BUILT ON RELATIONSHIPS

Need Prescription Drug Coverage? Give Us a Call

We offer free claim support for life!

At American Family Solutions, we will help you get the prescription coverage you need. To learn more about Medicare Part D and the options available to you, reach out to us today.