Part B

Medicare Part B is the medical insurance part of the Medicare program. If combined with Medicare Part A, you will have what is known as Original Medicare, and also receive hospital insurance.

Part B covers:

- Outpatient care

- Durable medical equipment

- Ambulance services

- Medically necessary services

- Preventive services

- Mental health care

To enroll in Part B, you can do so during your Initial Enrollment Period. This period starts three months before your 65th birthday month, then ends three months after your 65th birthday. This is the best time to enroll, but if you miss this period, you can enroll during the General Enrollment Period (January 1 – March 31).

Keep in mind that enrolling during the General Enrollment Period may mean paying late enrollment penalties.

What Are The Costs of Part B?

There are specific costs you must be aware of with Part B, which are outlined below:

Part B Monthly Premium:

- $170.10

- Could be higher for those with a higher income

Part B Deductible:

- $233 for the year

Part B IRMAA

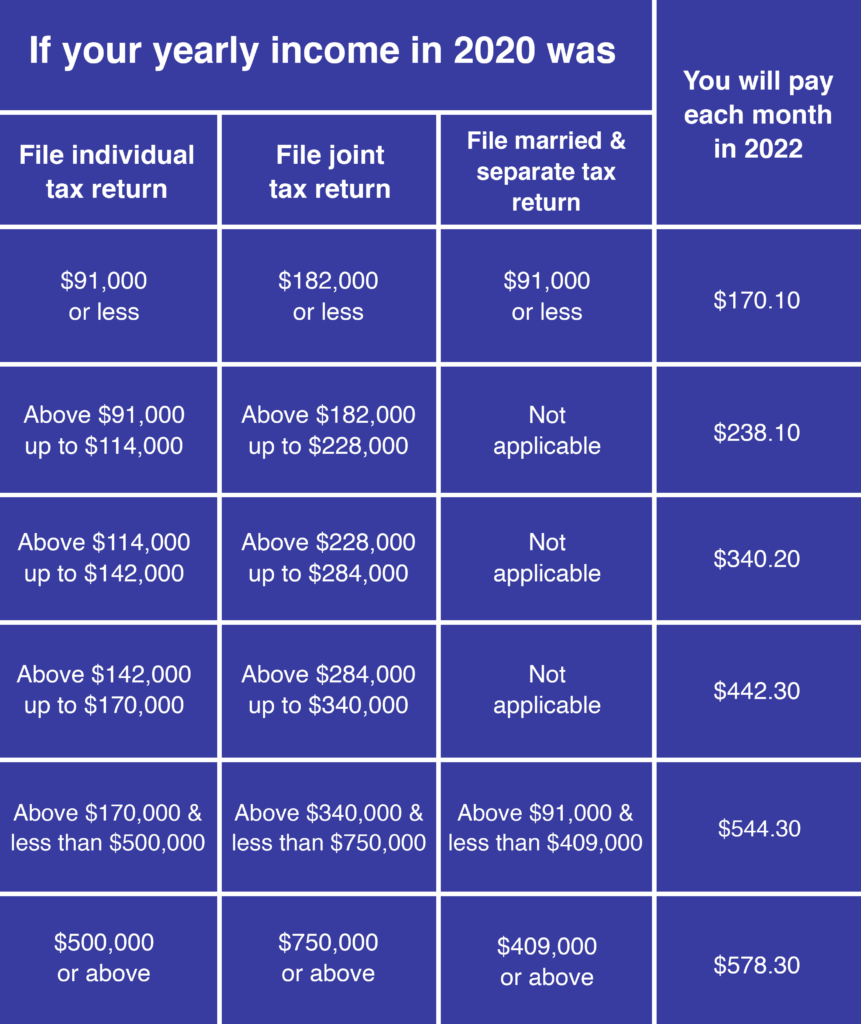

While Part B does have a standard monthly premium, this premium can be higher if you earn a higher income. This is known as the Income-Related Monthly Adjustment Amount (IRMAA).

How does this work? Your plan will decide what your Part B monthly premium will be based on what you filed on your tax return from two years prior. The higher the income, the higher your premiums may be.

The Part B IRMAA you can expect to see in 2022 is outlined below:

WE’RE BUILT ON RELATIONSHIPS

Learn More About Part B Today!

We offer free claim support for life!

At American Family Solutions, you are our first priority. We can help you enroll in Medicare Part B so you get the coverage you need. Give us a call today for more information!